Ripple (XRP) and Solana were notably less correlated with stocks than the other cryptocurrencies we looked at, with an almost moderate correlation coefficient of 0.7738 and 0.7709 respectively. Ethereum was rather high as well, while smaller altcoins like Dogecoin (0.8338) and Cardano (0.8849) had a slightly lower correlation coefficient. Bitcoin was just behind robo advisors and real estate in terms of stock market correlation, with a very high correlation coefficient of 0.9175. Most cryptoĬrypto was measured by the performance of Bitcoin, Ethereum, Dogecoin, Ripple, Cardano, and Solana. For example, the eREIT offered by Fundrise, which is a non-traded REIT, is significantly less correlated to the S&P 500 than its publicly-traded counterparts such as Vanguard's REITs. However, private and non-traded REITs can be largely uncorrelated to stocks. Our platforms include the most well-known robo advisors, such as Betterment, Wealthfront, Acorns, SoFi, Personal Capital, Vanguard's Digital Advisor, Schwab's Intelligent Portfolios, and Wells Fargo's Intuitive Investor.īecause these REITs are publicly traded on the same markets as equities, they tend to be subject to the same factors that cause stocks to move up and down. Data for robo advisor performance was pulled from our own proprietary robo advisor index. Most investors using robo advisors are doing so to invest in the stock market. This is predictable, considering robo advisors sell funds and indices that aren't too dissimilar from the S&P 500. Of those, robo advisors predictably had one of the highest correlation coefficients at 0.9345. While that doesn't necessarily mean they aren't great diversification tools for other reasons, it does mean that they might not offer as much recession protection as other asset classes. Strongly correlated assets-those with a correlation coefficient of 0.75 or greater-tend to follow stock market patterns. Most investment assets are correlated with the stock market. Crypto (Bitcoin, Ethereum, Dogecoin, Cardano, and Solana).However, there were two with a negative correlation. Most of the assets we studied had a positive correlation to the S&P 500 over this time period. The Pearson correlation coefficient in this study is calculated on a monthly basis from 2018 to 2021 with the exception of farmland and art, which are calculated on a quarterly basis. Strong negative correlation: -0.75 to -1.0.Moderate negative correlation: -0.50 to -0.75.Low negative correlation: -0.25 to -0.50.Moderate positive correlation: 0.50 to 0.75.

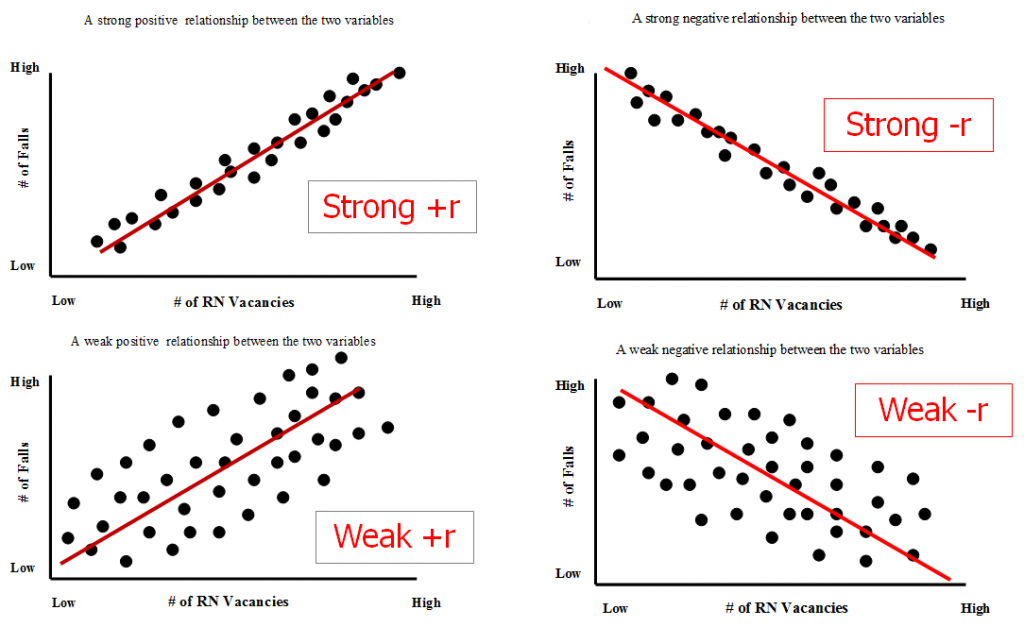

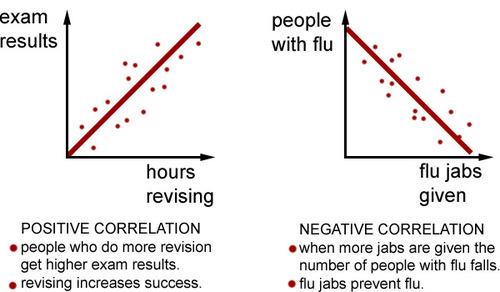

Strong positive correlation: 0.75 to 1.0.For the purpose of this study, here is how we define correlation using the correlation coefficient: For example, a correlation coefficient of 0.1 is low enough to suggest that any slight correlation found is likely coincidental and not an indicator of any real correlation. In reality, a correlation coefficient of exactly 1.0, -1,0, or zero is extremely rare, and a correlation coefficient that is close to zero still means there's little to no correlation. This means that the two assets move independently and have no relationship with each other. Finally, a correlation coefficient of zero represents no correlation. A negative number represents a negative correlation, meaning the assets are inversely correlated or tend to move in opposite directions-a -1.0 is a perfect negative correlation. This correlation coefficient can range from -1.0 to 1.0.Ī positive number represents a positive correlation, meaning the assets tend to move in the same direction-a 1.0 is a perfect positive correlation. Correlation between two assets is measured using a mathematical formula that produces what is called the Pearson correlation coefficient, represented by R.

0 kommentar(er)

0 kommentar(er)